NewsX24

Welcome to NewsX24, You will find the following things on newsx24.

- Latest News Update

- latest Yojana

- Latest Job Update

- Latest Entertainment Updates.

Latest PM Yojana

latest Rajasthan Scheme

Rajasthan Free Tablet Yojana

In the ever-evolving landscape of education, technology plays a pivotal...

Read MoreRajiv Gandhi Kisan Beej Uphar Yojana 2023

In the heartlands of India, where agriculture has been the...

Read MoreRajasthan Vidya Sambal Yojana 2023: Empowering Education

In the vibrant landscape of Rajasthan, where the rich tapestry...

Read MoreRajasthan Free Tractor and Agricultural Machine Scheme 2023

Empowering Rajasthan Farmers: The Rajasthan Free Tractor and Agricultural Machine...

Read MoreWeb Stories

10 Most Beautiful Small Towns in Missouri You Should Absolutely Visit

10 Most Beautiful Small Towns in Missouri You Should Absolutely...

Read MoreGardena plumber who lost $30,000 worth of tools frustrated with crime laws

Gardena plumber who lost $30,000 worth of tools frustrated with...

Read MoreResidents salvage what they can after blaze at Lomita apartment building

Residents salvage what they can after blaze at Lomita apartment...

Read More10 Fire Safety Items You Should Always Have In The House

10 Fire Safety Items You Should Always Have In The...

Read MoreTop 10 Coins Every Collector Dreams Of Owning

Top 10 Coins Every Collector Dreams Of Owning

Read MoreWinning numbers drawn for $800 million Powerball jackpot.

Winning numbers drawn for $800 million Powerball jackpot. Lotto fever...

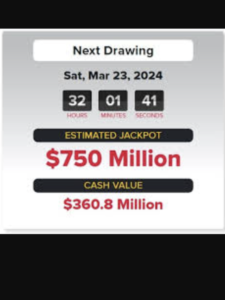

Read MoreWinning numbers drawn for $750 million Powerball jackpot

Winning numbers drawn for $750 million Powerball jackpot. The winning...

Read MoreHomeland Security agents raid L.A. mansion associated with Sean ‘Diddy’ Combs

Homeland Security agents raid L.A. mansion associated with Sean ‘Diddy’...

Read More10 Best Places To Live in Kentucky in 2024

10 Best Places To Live in Kentucky in 2024 10....

Read More10 Smoothie Bowl Recipes

10 Smoothie Bowl Recipes 10. Berry Smoothie Bowl10. Berry Smoothie...

Read More10 Best Places to Live in Georgia

10 Best Places to Live in Georgia 10. Marietta, GA10....

Read More10 Best Fruits That Go Well With Mango in a Smoothie

10 Best Fruits That Go Well With Mango in a...

Read More